Let Plains Insurance provide you with the perfect policy

Property Details

To be certain your home is insured properly and to value, we must ask appropriate questions to acquire the necessary information to provide you with a quotation.

Broker’s Role

We take the information you provided and forward it to the many insurance companies we represent. In this way, we are able to obtain the coverage you require at the best premium possible. Basically, we shop the marketplace for you.

Home, Condo and Tenants Insurance

A home is often the most important investment we’ll make in our lives. For this reason, it is imperative that you protect that investment in every way possible.

Home insurance not only protects the building itself; it also covers your belongings, provides liability coverage should someone hurt themselves on your property and includes additional living expense coverage should your home be uninhabitable due to a fire, flood or other insured loss. Seasonal and Vacation homes can be added as additional location(s) to your Homeowner’s policy.

Based on the information you give us, Plains Insurance will make certain your home is fully protected.

Rented, Seasonal, and Vacation Homes

As a landlord, you may find it a challenge to obtain coverage for your rental property as the insurance company is aware your tenant may not treat the property the way you, the owner would.

It is also important to find the right policy for your seasonal or vacation home to ensure your home away from home is protected.

Your best route is to approach the broker who insures your primary residence. Fortunately for Plains Insurance clients, we have a great deal of experience accessing this type of coverage.

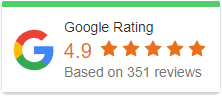

Choose Plains Insurance for Reliable Service

We aim to build relationships that benefit our clients.

Our goal is to serve the community of Edmonton and surrounding areas. This means that we work with strict values to make sure we're living up to our reputation as an insurance brokerage.

Call us to learn how we can benefit you.

Plains insurance believes every insurance situation is unique. That's why we encourage you to ask us any questions you might have! Drop in, give us a call today, or send us an email to get the answer to your biggest questions.