Why Choose Plains Insurance?

Personalized Service

At Plains Insurance we listen to you and work with you to make sure the proper coverage is there should you need it. We are in the service business: our clients are valued and we work to build lasting relationships with them.

Knowledge

Plains Insurance is a multi-faceted independent brokerage. We’ve got the expert you need! While any of us can help you with your every-day insurance needs, we also have “in-house” experts to assist with your personal, commercial, life, disability and specialty insurance needs.

Life Insurance

The primary purpose of life insurance is to protect survivors who depend on the insured person for financial support.

It is also important for business owners because it can help protect the business from financial loss, liabilities or instability in the event of an owner or business partner's death.

Since every person’s situation is different the needs and goals of the insured are always considered when initiating a policy.

Life insurance also enjoys a favourable tax treatment unlike any other financial instrument. Death benefits are generally income-tax-free to the beneficiary.

Term Life Insurance

There are two basic types of term life insurance policies: level term and decreasing term.

- Level term means that the death benefit stays the same throughout the duration of the policy.

- Decreasing term means that the death benefit drops, usually in one-year increments, over the course of the policy's term.

Term life insurance can cover mortgages, future college expenses, funeral and estate expenses, and even business ownership needs.

Permanent Life Insurance

Permanent insurance pays a death benefit whenever you die—even if you live to 100! There are many types of permanent insurance policies so coverage can be tailored to any need or situation.

This type of insurance is often referred to as cash-value insurance because the policy can build cash value over time, as well as provide a death benefit to your beneficiaries. If you decide to stop paying premiums and surrender your policy the cash value, whatever it is at the time, is yours.

Critical Illness and Disability Insurance

Illness and injuries are never planned yet create huge life changes and challenges. Critical Illness and Disability insurance protect you from the unexpected.

In the event of a big health emergency such as cancer, heart attack or stroke, critical illness insurance could be the only thing protecting you from financial ruin. It provides a lump-sum payment to help you with your finances so you can focus on dealing with your illness.

Disability insurance protects you when you are unable to work due to an injury or illness.

Call Plains Insurance today and one of our broker’s will find the best option at a price you can afford.

Group Benefits

Many employers offer group insurance coverage to their employees as part of their compensation package. This coverage protects the financial security of employees and their families and provides easier access to many types of health care.

Health Spending Accounts (HSA)

A health spending account provides an attractive option for eligible small businesses to pay for the medical expenses of employees and their families on a tax-free basis to the employee. HSA's are administered in accordance with Canada Revenue Agency guidelines.

Small business owners across Canada are reducing healthcare costs, protecting their family, and improving their business. Find out how Plains Insurance can help your business save money.

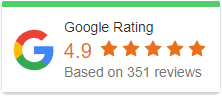

Plains Insurance Provides Reliable Service

We don’t serve our client’s needs with a one-size-fits-all mentality. Rather, we generate a policy that is specific to you and your situation.

The information you share with us allows us to deliver on our objective of providing the customized insurance coverage you require. First we’ll listen to you, then we'll ask you a few questions as we require certain information before we can provide you with a quotation. Why not contact us today to start the process? Free quotes-no obligation.

We have been providing clients from Edmonton, St. Albert, Sherwood Park, Spruce Grove and surrounding areas with customized insurance products for years.